What Is the Debt Snowball Method?

Watch this Video to understand Debt Snowball

The debt snowball method is a debt elimination strategy that prioritizes paying off smallest balances first. This approach builds psychological momentum through quick wins.

Created by financial expert Dave Ramsey, this method focuses on behavior modification over mathematical optimization. Psychology drives success more than perfect math.

The strategy gets its name from rolling payments into larger amounts like a snowball. Each paid-off debt adds to the next debt’s payment amount.

How the Debt Snowball Works

List all your debts from smallest balance to largest balance. Interest rates don’t matter in this ranking system.

Make minimum payments on all debts except the smallest one. Attack the smallest debt with every extra dollar available.

Once the smallest debt is eliminated, add that payment to the next smallest debt. This creates the “snowball effect” of increasing payments.

The Psychology Behind Debt Snowball

Small wins create psychological momentum that sustains long-term debt elimination efforts. Early victories build confidence and motivation.

Seeing debts disappear quickly provides emotional satisfaction that keeps people committed. This emotional component often determines success or failure.

The method addresses debt elimination as a behavioral challenge rather than purely mathematical. Sustainable habits matter more than optimal interest calculations.

Step-by-Step Debt Snowball Implementation

Step 1: List All Your Debts

Write down every debt you owe including credit cards, personal loans, and student loans. Include current balances and minimum monthly payments.

Don’t include your mortgage in this list as it’s typically handled separately. Focus on consumer debts and smaller loans initially.

Organize debts from smallest balance to largest balance regardless of interest rates. This ordering is crucial for the method’s psychological benefits.

Step 2: Calculate Available Extra Money

Review your monthly budget to find extra money for debt elimination. Look for areas where you can reduce spending temporarily.

Cancel unnecessary subscriptions, reduce dining out, and minimize entertainment expenses. These sacrifices are temporary while building financial freedom.

Consider increasing income through side hustles, overtime, or selling unused items. Every extra dollar accelerates your debt elimination timeline significantly.

Step 3: Attack the Smallest Debt

Continue making minimum payments on all debts to avoid penalties and credit damage. Focus all extra money on the smallest debt balance.

Throw every available dollar at this debt until it’s completely eliminated. The faster you eliminate it, the sooner you gain momentum.

Celebrate when you eliminate your first debt completely. This psychological victory fuels continued motivation for the remaining debts.

Step 4: Roll Payments to Next Debt

Take the total payment you were making on the eliminated debt. Add this amount to the minimum payment of your next smallest debt.

This creates the snowball effect where payments grow larger with each eliminated debt. The momentum builds automatically without additional effort.

Continue this process until all debts are eliminated completely. Each victory makes the next debt elimination faster and easier.

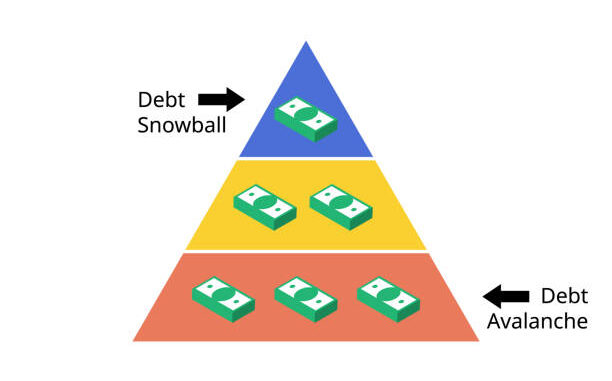

Debt Snowball vs. Debt Avalanche Method

Understanding the Debt Avalanche

The debt avalanche method prioritizes debts with the highest interest rates first. This approach minimizes total interest paid mathematically.

Mathematically, the avalanche method saves more money in interest payments. However, it may take longer to see the first debt eliminated.

The avalanche method works better for highly analytical people who stay motivated without frequent psychological wins. Discipline requirements are higher than snowball.

Comparing Total Interest Costs

The debt avalanche typically saves hundreds or thousands in interest payments. These savings increase with higher debt amounts and interest rate spreads.

However, the debt snowball’s psychological benefits often lead to faster debt elimination. Faster elimination can offset higher interest costs through time savings.

Most people benefit more from the snowball’s motivation than the avalanche’s mathematical efficiency. Behavioral factors determine success more than perfect optimization.

Which Method Should You Choose?

Choose the debt snowball if you need motivation and quick wins. This method works better for people who struggle with long-term discipline.

Select the debt avalanche if you’re highly disciplined and motivated by mathematical efficiency. This approach suits analytical personalities better.

Consider your personality, motivation levels, and debt situation when deciding. The method you’ll actually follow completely is the right choice.

Creating Your Debt Snowball Plan

Gathering Financial Information

Collect recent statements for all debts showing current balances and minimum payments. Accuracy is crucial for creating effective elimination plans.

Check credit reports to ensure you haven’t missed any debts. Hidden debts can derail your elimination progress significantly.

Note due dates for all debts to avoid late payment penalties. Maintain perfect payment timing throughout the elimination process.

Building Your Debt List

Example Debt Snowball List: • Credit Card A: $500 balance, $25 minimum payment • Personal Loan: $1,200 balance, $100 minimum payment • Credit Card B: $3,500 balance, $75 minimum payment • Student Loan: $8,000 balance, $150 minimum payment

Focus all extra payments on Credit Card A first. Once eliminated, attack the personal loan with $125 monthly ($100 + $25).

Setting Realistic Timelines

Calculate how long each debt will take to eliminate with your extra payments. These timelines help maintain motivation and track progress.

Be realistic about available extra money to avoid setting impossible goals. Sustainable progress beats unsustainable sprints consistently.

Adjust timelines as your financial situation changes or improves. Flexibility prevents discouragement when circumstances shift unexpectedly.

Maximizing Your Debt Snowball Success

Finding Extra Money for Payments

Review your budget line by line for potential savings opportunities. Small cuts across multiple categories can generate significant debt payments.

Sell unused items around your home for additional debt payments. Decluttering generates cash while simplifying your living space.

Consider temporary lifestyle adjustments like cooking more meals at home. These sacrifices accelerate debt elimination significantly when maintained consistently.

Increasing Your Income

Explore side hustles that match your skills and available time. Food delivery, freelance work, or tutoring can generate substantial extra income.

Ask for overtime hours at your current job if available. Additional work hours provide direct income increases for debt elimination.

Sell skills or services to friends, family, and neighbors. Lawn care, cleaning, or handyman services generate quick cash for debt payments.

Staying Motivated Through Challenges

Track your progress visually using charts or apps that show debt elimination. Seeing progress maintains motivation during difficult periods.

Celebrate small victories like paying off individual debts completely. Recognition reinforces positive financial behaviors and maintains momentum.

Share your goals with supportive family members or friends. Accountability partners encourage consistency and celebrate achievements with you.

Common Debt Snowball Mistakes

Not Having an Emergency Fund First

Build a small emergency fund of $500-$1,000 before starting aggressive debt elimination. This prevents new debt during minor emergencies.

Without emergency funds, unexpected expenses force you onto credit cards again. This cycle undermines all debt elimination progress made.

Learn more about building adequate emergency funds before beginning your debt snowball journey.

Ignoring Minimum Payments

Never skip minimum payments on any debt to focus on your target debt. Late payments damage credit scores and incur expensive penalties.

Minimum payments maintain good standing with creditors while you eliminate debts systematically. This protection preserves your credit rating.

Set up automatic minimum payments to ensure you never miss due dates. Automation prevents costly mistakes during intense debt elimination periods.

Adding New Debt During Elimination

Avoid using credit cards or taking new loans while eliminating existing debt. New debt defeats the purpose of elimination efforts.

Change your spending habits to live within your means completely. This behavioral change prevents future debt accumulation after elimination.

Consider removing credit cards from your wallet to avoid temptation. Physical barriers help maintain discipline during challenging moments.

Giving Up Too Early

Debt elimination takes time and sustained effort over months or years. Early enthusiasm often fades without visible progress quickly.

Remember that building debt took years, so elimination will take time too. Patience and persistence separate successful debt eliminators from quitters.

Focus on the freedom and peace of mind that debt elimination provides. These long-term benefits outweigh short-term sacrifices significantly.

Advanced Debt Snowball Strategies

Debt Snowball with Windfalls

Apply tax refunds, bonuses, or unexpected money directly to your current target debt. These windfalls can eliminate debts months ahead of schedule.

Resist the temptation to spend windfalls on purchases or vacations. Debt elimination provides better long-term satisfaction than temporary pleasures.

Large payments can eliminate multiple small debts at once sometimes. This acceleration builds tremendous momentum for remaining debt elimination.

Combining Methods Strategically

Consider a hybrid approach that balances psychology and mathematics effectively. Start with debt snowball for momentum, then switch to avalanche.

Eliminate 1-2 small debts quickly for psychological wins, then focus on high-interest debts. This combination maximizes both motivation and savings.

Customize your approach based on your specific debt situation and personality. The best method is one you’ll execute consistently.

Negotiating with Creditors

Contact creditors to request lower interest rates or payment arrangements. Many creditors prefer cooperation over default and may offer concessions.

Explain your debt elimination plan and commitment to full repayment. Creditors often appreciate proactive communication and may offer assistance.

Document any agreements in writing to avoid future misunderstandings. Written agreements protect both parties and ensure clarity.

Behavioral Changes for Long-Term Success

Developing New Money Habits

Create a detailed budget that accounts for every dollar monthly. Budgeting prevents overspending and identifies money for debt payments.

Use cash for discretionary spending to avoid credit card temptation. Physical money makes spending more tangible and controlled.

Practice delayed gratification by waiting 24-48 hours before non-essential purchases. This cooling-off period prevents impulse spending frequently.

Building Emergency Funds After Debt Elimination

Once debt-free, redirect debt payments to emergency fund building. This prevents future debt during unexpected financial challenges.

Build 3-6 months of expenses in emergency funds for comprehensive protection. Adequate reserves eliminate the need for credit cards during crises.

Maintain the same intensity and discipline used for debt elimination. These habits ensure long-term financial stability and success.

Creating Wealth After Debt Freedom

Begin investing debt payments after achieving debt freedom and adequate emergency funds. Compound growth builds substantial wealth over time.

The same monthly amounts that eliminated debt can build retirement wealth. This transformation from debt payments to wealth building is powerful.

Maintain frugal habits learned during debt elimination to maximize investment contributions. Lifestyle inflation defeats wealth building efforts quickly.

Technology Tools for Debt Snowball

Debt Tracking Apps

Use smartphone apps specifically designed for debt tracking and elimination. These tools automate calculations and provide visual progress tracking.

Popular apps like Debt Payoff Planner show elimination timelines and interest savings. Visual feedback maintains motivation throughout the elimination process.

Many apps allow you to compare snowball and avalanche methods. This comparison helps you choose the optimal strategy for your situation.

Budgeting Software Integration

Connect debt tracking with budgeting apps for comprehensive financial management. Integrated systems prevent money from being misallocated accidentally.

Automatic categorization helps identify extra money for debt payments. Technology simplifies the process of finding elimination funds monthly.

Set up alerts and reminders for payment due dates and budget limits. Automation prevents costly mistakes during debt elimination periods.

Spreadsheet Templates

Create or download debt snowball spreadsheets for detailed tracking and planning. Spreadsheets provide complete customization for unique situations.

Include columns for balances, payments, interest rates, and projected payoff dates. Comprehensive tracking maintains focus and motivation effectively.

Update spreadsheets monthly to track progress and adjust strategies accordingly. Regular updates maintain accuracy and provide motivation through visible progress.

Real-World Debt Snowball Success Stories

Case Study: Credit Card Debt Elimination

Sarah had four credit cards totaling $8,500 in debt. She listed them by balance: $500, $1,200, $2,800, and $4,000.

She found $300 extra monthly through budget cuts and side income. Attacking the smallest debt first, she eliminated it in two months.

Rolling that payment forward, she eliminated all debts in 18 months. The psychological momentum kept her motivated throughout the process.

Case Study: Mixed Debt Types

Mike had various debts: $800 personal loan, $2,500 credit card, $6,000 car loan, and $15,000 student loan.

Following debt snowball principles, he attacked the personal loan first despite higher interest rates elsewhere. Quick elimination provided crucial early motivation.

He became completely debt-free in 30 months, including his student loan. The momentum from early wins sustained him through the entire journey.

Common Success Factors

Successful debt eliminators maintain consistent extra payments throughout the process. Sporadic payments extend timelines and reduce motivation significantly.

They resist lifestyle inflation during the elimination period completely. Maintaining sacrifice until debt freedom ensures maximum effectiveness and speed.

Most importantly, they celebrate victories and maintain focus on long-term freedom. This mindset sustains effort through inevitable challenging periods.

Professional Guidance and Resources

When to Seek Help

Consider credit counseling if you’re overwhelmed by debt amounts or complexity. Non-profit organizations provide objective guidance and negotiation assistance.

Seek help if you cannot maintain minimum payments on all debts. Professional intervention can prevent more serious financial consequences.

Financial advisors help create comprehensive plans integrating debt elimination with other goals. Professional guidance optimizes overall financial strategy effectiveness.

Educational Resources

Investopedia provides comprehensive debt management education and comparison tools. Their calculators help evaluate different elimination strategies.

Books like “The Total Money Makeover” explain debt snowball principles thoroughly. Multiple perspectives help develop comprehensive understanding and commitment.

Podcasts and online communities provide ongoing motivation and support. Connecting with others eliminates feelings of isolation during challenging periods.

Credit Counseling Services

Non-profit credit counseling agencies offer free or low-cost debt management assistance. They provide objective analysis of your situation and options.

These organizations can negotiate with creditors for better terms sometimes. Professional negotiation often achieves better results than individual efforts.

Avoid for-profit debt settlement companies that charge high fees. These organizations often make situations worse rather than better.

Maintaining Momentum During Setbacks

Handling Financial Emergencies

Use your small emergency fund for true emergencies during debt elimination. Replace emergency fund money immediately to maintain protection.

Don’t let emergencies derail your entire debt elimination plan permanently. Resume aggressive payments as soon as the emergency is resolved.

Consider temporary payment reductions rather than stopping elimination completely. Maintaining some progress prevents complete momentum loss during difficulties.

Dealing with Motivation Loss

Remember your reasons for wanting debt freedom when motivation wanes. Write down these reasons and review them during challenging periods.

Recalculate your debt-free date to maintain focus on the end goal. Seeing the finish line helps sustain effort through difficult periods.

Consider adjusting your plan slightly rather than abandoning it completely. Flexibility prevents perfectionism from destroying good progress.

Celebrating Milestones

Acknowledge each eliminated debt with appropriate celebrations that don’t create new debt. Small rewards maintain motivation without undermining progress.

Share achievements with supportive friends and family members. Recognition from others reinforces positive financial behaviors effectively.

Track cumulative progress like total debt eliminated and interest saved. These larger numbers provide perspective during challenging elimination periods.

Conclusion

The debt snowball method provides a proven psychological approach to debt elimination. Small wins build momentum that sustains long-term elimination efforts.

List debts from smallest to largest balance and attack aggressively while maintaining minimum payments elsewhere. This systematic approach ensures steady progress.

The method’s behavioral focus often produces better results than mathematically optimal strategies. Psychology determines success more than perfect calculations.

Build a small emergency fund before beginning aggressive debt elimination. This protection prevents new debt during unexpected financial challenges.

Maintain discipline and consistency throughout the elimination process for maximum effectiveness. Sustainable habits ensure both debt freedom and long-term financial success.

Remember that debt freedom provides peace of mind and financial flexibility. These benefits justify temporary sacrifices during the elimination period significantly.

Frequently Asked Questions

How long does the debt snowball method typically take?

Debt elimination timelines vary based on total debt amounts and available extra payments. Most people achieve freedom in 18-36 months with consistent effort.

Small debts (under $10,000) can often be eliminated in 12-24 months. Larger debt loads may require 3-5 years depending on income and expenses.

The key is maintaining consistent extra payments throughout the process. Sporadic payments extend timelines significantly and reduce psychological momentum.

Should I include my mortgage in the debt snowball?

Typically, exclude mortgages from debt snowball calculations due to their size and tax benefits. Focus on consumer debts and smaller loans first.

Mortgages have lower interest rates and provide tax deductions usually. These factors make them less urgent than high-interest consumer debts.

Consider tackling mortgages after eliminating all consumer debt and building adequate emergency funds. This sequence optimizes overall financial progress.

What if I can’t find extra money for debt payments?

Start by tracking all expenses for one month to identify spending patterns. Most people find surprising opportunities for reductions.

Consider temporary lifestyle adjustments like reducing dining out, entertainment, or subscription services. Small cuts across multiple categories add up quickly.

Explore income increases through side hustles, overtime, or selling unused items. Additional income often provides easier solutions than expense reduction alone.

How do I stay motivated when progress feels slow?

Track progress visually using charts, apps, or spreadsheets that show debt elimination. Seeing numbers decrease maintains motivation during challenging periods.

Focus on the number of debts eliminated rather than just dollar amounts. Each eliminated debt represents progress regardless of its size.

Celebrate small victories and milestones throughout the process regularly. Recognition reinforces positive behaviors and maintains momentum effectively.

Is the debt snowball method better than debt avalanche?

Debt snowball works better for most people due to its psychological benefits. Quick wins maintain motivation better than mathematical optimization usually.

Debt avalanche saves more money in interest but requires higher discipline levels. Choose based on your personality and motivation patterns.

The method you’ll actually complete is the right choice for you. Consistency matters more than theoretical optimization in debt elimination.

What happens after I become debt-free using this method?

Redirect debt payments to emergency fund building until you have 3-6 months of expenses saved. This prevents future debt during financial emergencies.

Begin investing the same monthly amounts once adequate emergency funds are established. Wealth building replaces debt payments using proven discipline habits.

Maintain frugal habits learned during debt elimination to maximize investment contributions. Lifestyle inflation defeats wealth building efforts quickly and effectively.

Leave a Reply