What Is Compound Interest?

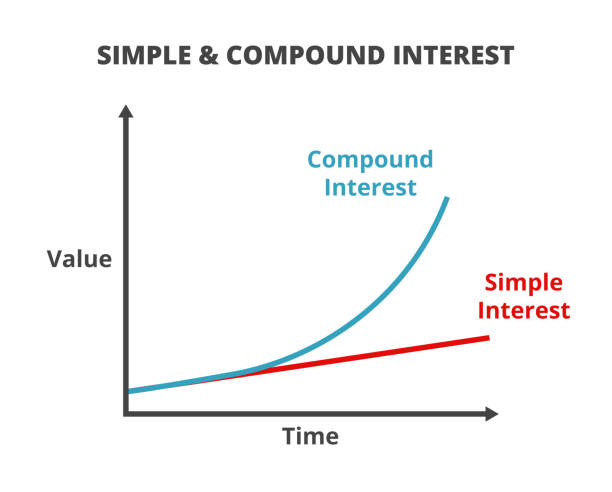

Compound interest is the process of earning returns on both your original investment and previously earned interest. This creates exponential growth over time.

Unlike simple interest that only pays on the principal amount, compound interest builds wealth by reinvesting returns. Each period’s earnings become part of the base for future calculations.

The frequency of compounding affects total returns significantly. More frequent compounding periods generate higher returns over identical timeframes.

Simple Interest vs. Compound Interest

Simple interest calculates returns only on the original principal amount. A $1,000 investment at 5% simple interest earns $50 annually.

Compound interest earns returns on the growing total balance each period. The same investment compounds to earn increasingly larger dollar amounts yearly.

This difference becomes dramatic over long periods. Compound interest vastly outperforms simple interest given sufficient time to work.

The Magic of Exponential Growth

Compound interest creates exponential rather than linear growth patterns. Early years show modest growth while later years produce dramatic increases.

The compounding curve starts slowly but accelerates significantly over time. This J-curve pattern explains why time is so crucial for wealth building.

Mathematical compounding creates wealth that seems almost magical to many investors. Understanding this process helps explain how ordinary people become wealthy.

How Compound Interest Works

The Basic Formula

The compound interest formula is: A = P(1 + r/n)^(nt), where A is the final amount, P is principal, r is annual interest rate, n is compounding frequency, and t is time in years.

This formula shows how all variables work together to determine final outcomes. Small changes in any variable create significant long-term differences.

Understanding this formula helps investors make better decisions about contributions, rates, and timeframes. Mathematical literacy improves investment outcomes substantially.

Compounding Frequency Effects

Annual compounding calculates interest once per year on the total balance. This represents the simplest compounding scenario for most investors.

Monthly compounding calculates interest twelve times annually, creating slightly higher returns. Credit cards typically compound monthly for maximum interest extraction.

Daily compounding provides the highest returns for most practical purposes. The difference between daily and continuous compounding is negligible.

Real World Example

Consider investing $5,000 annually for 30 years at 8% compound interest. This investment grows to approximately $566,000 total.

The same contributions with simple interest would total only $265,000. Compound interest generates over $300,000 in additional wealth.

This example demonstrates why compound interest is often called the eighth wonder of the world. The numbers seem almost too good to be true.

The Time Factor: Why Starting Early Matters

The Power of Time

Time is the most important variable in compound interest calculations. Early starters have massive advantages over later investors.

A 22-year-old investing $2,000 annually until age 30 accumulates more wealth than someone starting at 30 and contributing until retirement. Time beats contribution amounts consistently.

This demonstrates why financial education should begin early in life. Young people have the greatest wealth-building advantage through time.

Real-World Time Comparison

Early Starter: Invests $2,000 annually from age 22-30 (9 years, $18,000 total contributions). At 8% compound interest, this grows to $944,641 by age 65.

Late Starter: Invests $2,000 annually from age 30-65 (36 years, $72,000 total contributions). This grows to only $518,113 by age 65.

The early starter invests $54,000 less but accumulates $426,528 more wealth. This dramatic difference illustrates time’s incredible power in compound interest.

Procrastination Costs

Every year of delayed investing costs enormous amounts of potential wealth. A single year’s delay in starting can cost tens of thousands in retirement funds.

Procrastination is the enemy of compound interest and wealth building. Perfect timing never arrives, but starting immediately always benefits investors.

Young investors often focus on immediate needs while ignoring long-term wealth building. This short-term thinking costs them their best wealth-building years.

Why Compound Interest Makes You Rich

Exponential Growth Creates Wealth

Linear growth adds the same amount each period while exponential growth multiplies the total each period. Compound interest creates exponential wealth accumulation.

The wealthy understand exponential growth principles and use them consistently. This mathematical advantage helps explain wealth inequality in society.

Ordinary people can become wealthy through consistent application of compound interest principles. No special skills or connections are required.

The Snowball Effect

Compound interest works like a snowball rolling downhill, growing larger and faster over time. Small beginnings create massive results given sufficient time.

Early compound interest growth appears slow and discouraging to many investors. However, patience through these early years enables extraordinary later growth.

The acceleration phase of compound interest creates wealth that surprises even experienced investors. Mathematical compounding exceeds most people’s intuitive expectations.

Breaking the Trading Time for Money Trap

Most people trade time directly for money through employment. This linear relationship limits wealth accumulation to earned income.

Compound interest allows money to work independently of your time. Investment returns continue growing whether you’re sleeping, working, or vacationing.

This passive wealth accumulation enables financial independence and early retirement. Money working for you eventually exceeds money you earn actively.

Compound Interest in Different Investments

Savings Accounts

High-yield savings accounts offer compound interest with complete safety. Current rates around 4-5% provide modest but guaranteed compound growth.

FDIC insurance protects savings account principal up to $250,000 per account. This safety makes savings ideal for emergency funds and short-term goals.

However, savings account returns barely exceed inflation over long periods. These accounts preserve purchasing power but rarely create significant wealth.

Stock Market Investments

Stock investments historically provide the highest compound interest returns over long periods. The S&P 500 has averaged approximately 10% annually since 1926.

Stock market compound interest creates the greatest wealth for long-term investors. Patient investors benefit from business growth and dividend reinvestment.

However, stock volatility can temporarily interrupt compound interest accumulation. Market downturns test investor patience and commitment to long-term strategies.

Bond Investments

Bonds provide predictable compound interest through regular coupon payments and reinvestment. Government bonds offer safety while corporate bonds provide higher returns.

Bond compound interest is more predictable than stocks but typically generates lower returns. This trade-off suits conservative investors and those approaching retirement.

Rising interest rates can reduce bond values temporarily but improve future compound returns. Bond investors must balance current value fluctuations against long-term compounding benefits.

Real Estate Investments

Real estate provides compound interest through property appreciation and rental income reinvestment. Leverage amplifies these compounding effects significantly.

Rental properties generate cash flow that can be reinvested for additional compound growth. This creates multiple compounding streams within real estate portfolios.

However, real estate requires active management and carries concentration risk. Diversification across multiple properties reduces but doesn’t eliminate these risks.

Maximizing Compound Interest

Start as Early as Possible

Beginning compound interest investing in your twenties provides 40+ years for growth. This time advantage cannot be replicated through higher contributions alone.

Even small amounts invested early create substantial wealth over time. A $50 monthly investment started at age 20 can generate significant retirement wealth.

Young investors should prioritize investing over lifestyle inflation or luxury purchases. Delayed gratification enables extraordinary long-term wealth accumulation.

Invest Regularly and Consistently

Dollar-cost averaging through regular investments amplifies compound interest benefits. Consistent investing removes market timing concerns and builds wealth systematically.

Automatic investing ensures consistency without requiring ongoing decision-making or willpower. Automation treats investing like a monthly bill payment.

Market volatility actually enhances compound interest for regular investors. Lower prices during downturns allow purchasing more shares with identical contributions.

Reinvest All Earnings

Dividend reinvestment plans (DRIPs) automatically compound stock returns without additional contributions. This reinvestment maximizes compound interest effects over time.

Spending investment earnings prevents compound interest from working effectively. Lifestyle inflation using investment returns destroys long-term wealth building potential.

Reinvestment discipline separates successful long-term investors from those who never build substantial wealth. Short-term gratification destroys long-term compound benefits.

Use Tax-Advantaged Accounts

401(k) accounts provide tax-deferred compound interest growth plus potential employer matching. These accounts maximize compound interest through reduced tax drag.

Roth IRAs offer tax-free compound growth for qualified withdrawals. Young investors particularly benefit from decades of tax-free compounding potential.

HSA accounts provide triple tax benefits with unlimited compound interest potential. These accounts offer the best tax advantages for eligible investors.

Compound Interest Calculation Examples

Basic Calculation Example

Principal: $10,000, Interest Rate: 7%, Time: 20 years, Compounding: Annual Final Amount: $10,000 × (1.07)^20 = $38,696

This investment nearly quadruples over 20 years through compound interest alone. No additional contributions were required to achieve this growth.

The same investment with simple interest would equal only $24,000. Compound interest generated an additional $14,696 in wealth.

Monthly Contribution Example

Monthly Investment: $500, Interest Rate: 8%, Time: 30 years, Compounding: Monthly Total Contributions: $180,000, Final Value: $679,692

Regular contributions combined with compound interest create substantial wealth over time. The investment earnings of $499,692 exceed total contributions significantly.

This example shows how ordinary people can become wealthy through consistent investing. No special knowledge or large initial investments are required.

Retirement Planning Example

Age 25 investor contributing $6,000 annually to a Roth IRA at 9% compound interest accumulates over $2.1 million by age 65.

Total contributions equal only $240,000 over 40 years. Compound interest generates over $1.86 million in additional wealth.

This demonstrates how modest annual contributions can fund comfortable retirement through compound interest. Early starting provides enormous advantages over delayed investing.

Common Compound Interest Mistakes

Starting Too Late

Procrastination costs more in compound interest than any other investment mistake. Each delayed year costs exponentially more potential wealth.

Many people wait for perfect market conditions or higher incomes before starting. Perfect timing never arrives, but compound interest rewards immediate action.

Starting with small amounts beats waiting for larger contributions. Time is more valuable than contribution size in compound interest calculations.

Withdrawing Money Early

Early withdrawals destroy compound interest accumulation and often trigger tax penalties. These withdrawals cost far more than the immediate benefit received.

Emergency fund withdrawals are sometimes necessary, but investment account withdrawals should be avoided. Proper financial planning prevents most early withdrawal needs.

Consider loans against retirement accounts before withdrawals if emergency funds are insufficient. Loans preserve compound interest while providing needed cash.

Not Reinvesting Earnings

Spending dividends, interest, or capital gains prevents compound interest from working effectively. These earnings must be reinvested to maximize long-term wealth building.

Lifestyle inflation using investment returns destroys decades of compound interest benefits. Discipline in reinvestment separates wealthy investors from others.

Automatic reinvestment plans eliminate the temptation to spend investment earnings. This automation ensures compound interest works without ongoing decisions.

Ignoring Inflation

Nominal compound interest returns don’t account for inflation’s wealth-destroying effects. Real returns after inflation determine actual purchasing power growth.

Historical stock market returns of 10% become approximately 7% after average inflation. This real return still provides substantial compound wealth building.

Focus on real returns rather than nominal returns when planning long-term wealth. Inflation protection becomes more important over longer time horizons.

Compound Interest and Debt

How Debt Works Against You

Credit card debt compounds against consumers at rates often exceeding 20% annually. This reverse compound interest destroys wealth faster than most investments create it.

High-interest debt should be eliminated before focusing on investment compound interest. Guaranteed debt reduction returns often exceed uncertain investment returns.

Understanding compound interest helps explain why debt elimination should precede wealth building. The mathematics strongly favor debt elimination for most people.

Good Debt vs. Bad Debt

Mortgage debt often carries low interest rates and provides tax deductions. This “good debt” allows simultaneous investing while maintaining reasonable borrowing costs.

Student loan debt typically has moderate rates and potential tax benefits. These loans often allow concurrent investing depending on specific interest rates.

Credit card and personal loan debt almost always carries rates exceeding investment returns. This “bad debt” should be eliminated before serious wealth building begins.

Strategic Debt Management

Compare debt interest rates to potential investment returns when making financial decisions. Mathematical analysis reveals optimal strategies for each situation.

Consider debt consolidation to reduce interest rates and accelerate payoff timelines. Lower rates free up money for compound interest investing.

Balance debt elimination and investing based on specific rates and tax considerations. Optimal strategies vary by individual circumstances and interest rate environments.

Advanced Compound Interest Strategies

Tax Optimization

Tax-deferred accounts like 401(k)s maximize compound interest by eliminating annual tax drag. Taxes are deferred until withdrawal during retirement.

Tax-free accounts like Roth IRAs provide even greater compound benefits for young investors. Decades of tax-free growth create enormous wealth accumulation.

Taxable account strategies include tax-loss harvesting and holding periods for capital gains treatment. These techniques reduce tax drag on compound returns.

Asset Allocation Impact

Diversified portfolios balance growth and stability for optimal compound interest over long periods. All-stock portfolios provide higher returns with greater volatility.

Age-based allocation adjusts risk levels as compound interest accumulates wealth. Younger investors can accept higher volatility for greater compound returns.

Rebalancing maintains target allocations while potentially enhancing compound returns. This discipline forces buying low and selling high systematically.

International Diversification

Global investing provides compound interest opportunities beyond domestic markets. International diversification reduces portfolio risk while maintaining return potential.

Emerging markets offer higher compound interest potential with increased volatility risks. Developed international markets provide diversification with moderate additional risk.

Currency considerations affect international compound returns for U.S. investors. Dollar strength or weakness impacts foreign investment compound interest calculations.

Behavioral Aspects of Compound Interest

The Psychology of Delayed Gratification

Compound interest rewards those who can delay current consumption for future wealth. This psychological challenge prevents many people from building substantial wealth.

The marshmallow test demonstrates how delayed gratification predicts life success. Compound interest investing requires similar psychological discipline and patience.

Understanding behavioral finance helps investors maintain compound interest strategies during difficult periods. Emotional control enables mathematical wealth building principles to work.

Overcoming Instant Gratification

Modern society encourages immediate consumption over long-term compound interest building. Social media and advertising constantly promote spending over saving.

Visualization techniques help investors focus on long-term compound interest outcomes. Seeing future wealth potential motivates present-day sacrifice and discipline.

Automatic investing removes daily decision-making from compound interest building. This systematic approach overcomes psychological barriers to consistent investing.

Building Wealth Habits

Small daily financial decisions compound over time just like investment returns. Good financial habits create multiple streams of compound benefits.

Tracking net worth monthly provides motivation for continued compound interest investing. Visual progress encourages persistence during slow growth periods.

Surrounding yourself with financially successful people reinforces compound interest mindset. Peer groups significantly influence financial behaviors and outcomes.

Professional Resources and Education

Educational Materials

Investopedia provides comprehensive compound interest education and calculators. Their resources help investors understand and apply compounding principles effectively.

Personal finance books explain compound interest concepts through stories and examples. Multiple perspectives help solidify understanding of wealth-building principles.

Online courses and webinars teach compound interest applications for various investment strategies. Continuing education improves investment decision-making over time.

Professional Guidance

Fee-only financial advisors provide objective compound interest planning without sales conflicts. Their guidance helps optimize compounding strategies for individual circumstances.

Certified Financial Planners (CFPs) understand compound interest applications across comprehensive financial planning. They integrate compounding into retirement, education, and estate planning.

Robo-advisors automate compound interest investing through low-cost, diversified portfolios. These platforms make professional investment management accessible to smaller investors.

Compound Interest Tools

Online calculators demonstrate compound interest scenarios for different variables. These tools help visualize long-term wealth building potential accurately.

Spreadsheet models allow detailed compound interest analysis with custom assumptions. Advanced users can model complex scenarios and sensitivities.

Investment apps provide real-time compound interest tracking and portfolio growth. Technology makes monitoring compound progress easier and more engaging.

Conclusion

Compound interest transforms ordinary investors into wealthy individuals through mathematical principles and time. Understanding and applying these concepts creates extraordinary long-term results.

Starting early provides the greatest compound interest advantage that cannot be replicated through higher contributions alone. Time is the most valuable wealth-building resource.

Consistent investing and reinvestment maximize compound interest benefits over multiple market cycles. Discipline and patience separate successful wealth builders from others.

Tax-advantaged accounts amplify compound interest effects by reducing drag from annual taxation. These accounts should be maximized before taxable investing.

Remember that compound interest works best for patient investors focused on decades rather than years. Short-term thinking destroys long-term compound benefits.

Embrace the mathematical reality that compound interest creates wealth for those who understand and apply its principles consistently over time.

Frequently Asked Questions

How is compound interest different from simple interest?

Simple interest calculates returns only on the original principal amount each period. Compound interest calculates returns on both principal and previously earned interest.

This difference creates exponential growth over time for compound interest. Simple interest produces linear growth that significantly underperforms compounding over long periods.

Most real-world investments use compound interest calculations, making understanding this concept essential for all investors and savers.

What is the rule of 72 and how does it relate to compound interest?

The rule of 72 estimates how long it takes money to double at a given compound interest rate. Divide 72 by the interest rate to get approximate doubling time.

For example, money compounds at 8% interest doubles approximately every 9 years (72 ÷ 8 = 9). This rule provides quick mental calculations for compound growth.

While not perfectly accurate, the rule of 72 helps investors understand compound interest time horizons and make better financial decisions.

Can I get compound interest from a regular savings account?

Yes, most savings accounts compound interest monthly or daily on your account balance. However, current savings rates are relatively low compared to investment returns.

High-yield savings accounts offer better compound interest rates while maintaining FDIC insurance protection. These accounts suit emergency funds and short-term savings goals.

For long-term wealth building, investment accounts typically provide superior compound interest potential despite higher risk levels.

How often should investments compound for maximum benefit?

Daily compounding provides the highest returns for practical purposes, though the difference from monthly compounding is small. Annual compounding provides the lowest returns.

Most investment accounts effectively compound continuously through reinvested dividends and capital appreciation. The key is ensuring all earnings are reinvested rather than spent.

Focus more on investment return rates and consistency rather than compounding frequency. Higher returns compound more significantly than slightly more frequent compounding.

Is it ever too late to benefit from compound interest?

It’s never too late to benefit from compound interest, though earlier starts provide dramatically better results. Even starting at age 50 allows 15+ years for compound growth.

Later starters must typically contribute more money to achieve similar wealth targets. However, compound interest still provides significant benefits over any multi-year period.

The best time to start was 20 years ago, but the second-best time is today. Immediate action beats continued procrastination regardless of age.

How does inflation affect compound interest returns?

Inflation reduces the real purchasing power of compound interest returns over time. Nominal returns must exceed inflation to build actual wealth.

Historical stock market returns of 10% become approximately 7% real returns after 3% average inflation. This real return still provides substantial compound wealth building.

Focus on investments that historically outpace inflation over long periods. Stocks and real estate typically provide better inflation protection than bonds or savings accounts.

Leave a Reply